How Booking.com made $24 Billion last year— Even With 30%+ cancellations

The genius monetization engine behind the world’s largest travel platform—and what every product & strategy leader should steal from it

Follow me on Linkedin here to get the mid week monetization bites

Quick favor before you dive in:

These posts take hours to craft, and your likes, shares, & comments go a long way in helping Monestra reach more curious minds.

If something resonates, drop a like or share with friends. And if you have questions — my DMs are always open. 🙏

From Amsterdam Ambition to Global Domination

Booking.com's journey began in 1996 when Geert-Jan Bruinsma, inspired by seeing Hilton.com allow hotel bookings in the United States, realized he couldn't book a hotel room online in Amsterdam. This gap in the market led him to create Bookings.nl from a small office space in Amsterdam, Netherlands.

Moving to today, Booking.com operates as part of Booking Holdings with a record revenue of $23.7 billion in 2024, representing an 11.11% YoY increase. In 2023 alone, consumers booked 1,049 million room nights of accommodation, 74 million rental car days, and 36 million airplane tickets using Booking Holdings' websites. Let’s dive in straight on how the company makes money…

Contest Alert: Comment below your best learning & its application : be it in a line or a para & get featured in our mid week monetization bites

Table of Contents

I. The Origin Story: From Amsterdam Ambition to Global Domination

II. Revenue Streams Overview

III. Deep Dive: Dissecting Each Revenue Stream

A. Revenue Stream 1: Merchant Model

B. Revenue Stream 2: Agency Model

C. Revenue Stream 3: Advertising & Marketing Services

V. The Competitive Moat: Why Booking.com Dominates

IV. Recent Innovations and Strategic Moves

Revenue Stream Breakdown (2024):

1. Merchant Revenues: 59.57% (~$14.1 billion) up from 50% previously

Merchant revenues are derived from transactions where the company facilitates payments from travelers for the services provided. In this model, Booking.com acts as the merchant of record, collecting payment from travelers and then paying accommodation providers minus their commission.

2. Agency Revenues: 35.91% (~$8.5 billion) The remaining portion of core booking revenue comes from the traditional commission model where Booking.com operates more like a traditional travel agent, earning commissions when travelers complete their stays at partner properties after reserving seats online.

3. Advertising and Other Revenues: 4.52% (~$1.1 billion): Fastest growing 8%+ YoY

This includes sponsored listings, premium placement fees from hotels wanting better visibility, and various advertising products.

Deep Dive: Dissecting Each Revenue Stream

Revenue Stream 1: Merchant Model

What It Is & How It Works

The merchant model is Booking.com's primary revenue driver where the company acts as the "merchant of record." When customers book and pay upfront, Booking.com collects the full payment immediately, then pays the hotel later minus their commission.

Example of a Transaction Flow:

Customer books a $200/night hotel room for 3 nights ($600 total)

Booking.com charges the customer's credit card immediately

The hotel receives 75-85% of that amount ($450-510) after the stay

Booking.com keeps 15-25% ($90-150) as their commission

The above is after the transaction fees (by acquirer bank, payment networks) are deducted from the booking amount

Why It's Great for Booking.com

Immediate cash flow: Money comes in before services are delivered

High margins: 15-25% commission with minimal variable costs

Risk transfer: Hotels bear the risk of no-shows and cancellations

Payment processing control: Booking.com handles all payment complexities

Customer relationship ownership: Direct billing relationship with travelers

Risks and Cons

Higher customer acquisition costs since the Co. owns the customer relationship

Payment processing liability: for fraud, chargebacks, and payment disputes

Currency and regulatory risks: across geographies with different regulations

Hotel dependency: If major hotel chains pull out, it directly impacts revenue

Revenue Stream 2: Agency Model

What It Is & How It Works

In the agency model, Booking.com operates like a traditional travel agent. Customers pay the hotel directly upon arrival or checkout, and hotels pay Booking.com a commission afterward for the referral.

The Transaction Flow:

Customer books through Booking.com but pays nothing upfront

Customer pays hotel directly during their stay

Hotel pays Booking.com a commission (typically 10-20%) after the check out

Why It's Great for Booking.com

Lower operational complexity: No payment processing, fraud risk, or currency exposure, no customer service burden regarding payments

Easier international expansion: Fewer regulatory hurdles

Faster partner onboarding: Hotels more willing to join with lower-risk model

Scalable with minimal infrastructure: Can add properties without payment system & hotel’s CRM integrations

Risks and Cons

Lower commission rates: Typically 10-20% vs 15-25% in merchant model

Collection risk: Hotels might delay or dispute commission payments

Weaker customer relationship: Hotel has direct relationship with guest

Revenue timing uncertainty: Commissions come after stays, not at booking

Revenue Stream 3: Advertising & Marketing Services

What It Is & How It Works

This revenue stream comes from hotels paying extra to increase their visibility and bookings on Booking.com's platform. It includes various advertising products and marketing tools.

Core Advertising Products:

1. Booking Network Sponsored Ads (Premium Placement) with a Cost-per-click (CPC) advertising solution starting from $0.50 per click

2. Enhanced Property Listings

Visual Upgrades: Additional photos, enhanced property descriptions, etc

Feature Badges: "Premium Partner," "Guest Favorite," and other labels

Promotional Tools: Highlighted deals, last-minute offers, and special packages

3. Targeted Marketing Services

Audience Segmentation: Reach specific traveler demographics and preferences

Retargeting Campaigns: Re-engage users who viewed but didn't book properties

Performance Analytics & market intelligence: reporting & pricing tools

4. Cross-Platform Advertising providing Multi-Brand Exposure: Access to combined global audience across Booking.com, Priceline, and Agoda

Why It's Great for Booking.com

Extremely high margins: Minimal marginal costs once platform exists

Recurring revenue: Hotels continuously invest in visibility

Competitive moat strengthening: Creates barriers for new entrants

Data monetization: Leverages existing user behavior data

Scalable across existing inventory: Same hotels can buy multiple products

Risks and Cons

Dependent on platform traffic, only works if customers use the platform

Potential partner alienation: Smaller hotels may feel disadvantaged by pay-to-play model

Regulatory scrutiny: Advertising practices face increased government oversight

Market saturation risk: Limited inventory positions available for premium placement which may lead to discontent among hotels wanting promotions

The Competitive Moat: Why Booking.com Dominates

Network Effects at Scale

Booking.com has built an almost insurmountable competitive advantage through network effects:

Supply Side Benefits:

More hotels join because of massive customer demand

Better inventory availability attracts more customers

Demand Side Benefits:

More customers mean better prices through volume negotiations

Larger selection keeps customers from going elsewhere

User reviews and data improve the experience

Data and Technology Advantage

The company processes billions of data points daily, allowing them to:

Optimize pricing in real-time (high efficiency dynamic pricing)

Personalize search results and recommendations

Improve conversion rates through constant experimentation

Global Market Penetration

Unlike many tech companies that struggle with international expansion, Booking.com mastered localization early. They operate in over 40 languages and understand local travel patterns, payment preferences, and cultural nuances in different markets.

Three Recent Innovations and Strategic Moves

1. Expanding Beyond Accommodation

Booking.com's "Connected Trip" strategy represents a fundamental shift from being just an accommodation platform to becoming a comprehensive travel ecosystem. The company reported a 40% increase in 'Connected Trip' transactions, signaling strong momentum in this diversification.

‘connected trip’ – enabling users to book every aspect of their travel experience seamlessly through website or mobile app

Key Expansion Areas:

Alternative Accommodations: Accelerated growth in room nights for alternative accommodations during Q4 2024, including vacation rentals, apartments, and unique stays that compete directly with Airbnb

Transportation Integration: Full-service travel booking including flights, rental cars, airport transfers, and ground transportation

Experience Economy: Tours, attractions, restaurant reservations, and local experiences that extend the revenue opportunity

Business Travel Platform: Booking for Business targets the lucrative corporate travel market with expense management and corporate rate negotiations

2. AI and Technology Investments

Current AI Implementations:

Smart Filters: AI-powered features including Smart Filter, Property Q&A, and Review Summaries to simplify trip planning

Generative AI for Travel Planning: AI will help travelers manage trips by handling things like flight cancellations with real-time solutions

Partner Tools: Partnered with HotelTechReport.com to launch the AI Tech Stack Advisor for hoteliers

Predictive Analytics: Using machine learning for dynamic pricing, demand forecasting, and personalized recommendations

Agentic AI Strategy: The company is preparing for the next wave of AI that can autonomously handle complex travel tasks. This includes AI agents that can:

Plan entire trips based on natural language requests

Handle real-time disruptions and rebooking

Negotiate prices and alternatives automatically

Provide 24/7 personalized travel assistance

3. Strategic Acquisitions

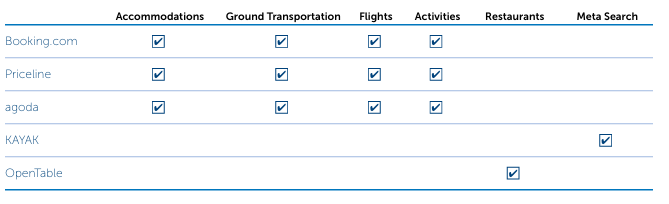

Booking Holdings has built its empire through a series of strategic acquisitions that created one of the most comprehensive travel ecosystems in the world. CEO Glenn Fogel led major strategic initiatives including the key acquisitions of Booking.com, KAYAK, OpenTable, RentalCars.com and Agoda.com.

Acquisition Strategy Logic:

Geographic Expansion: Acquiring local leaders in key markets (Agoda for Asia, Momondo for Europe)

Vertical Integration: Owning the entire travel stack from search (KAYAK) to booking (Booking.com) to dining (OpenTable)

Technology Acquisition: Buying specialized technology and talent rather than building from scratch

Market Defense: Preventing competitors from acquiring strategic assets

Most acquisitions are based on one or mix of the above logic that provides Booking.com with clear competitive advantages

The Bottom Line

Booking.com's $24 billion revenue machine is built on a deceptively simple foundation: connecting travelers with accommodations while taking a cut of every transaction. But the execution is anything but simple. Through relentless focus on user experience, massive scale advantages, and smart expansion into adjacent revenue streams, they've created one of the most profitable and defensible business models in the digital economy.

It took a week to complete this post, support my work by liking this post here

If you enjoyed this post…

Don’t miss out on real world monetization strategies delivered to you, once a week

For real world insights on monetization & pricing connect with me on Linkedin

Looking to optimize your revenue & pricing for your business?, lets chat

Contest Alert: Comment below your best learning & its application : be it in a line or a para & get featured in our mid week monetization bites

In these tough times, help job seekers by filling the following survey